Top 3 Cost-Effective Retirement Plans in South Africa

A retirement annuity (RA) is a type of investment product where individuals contribute monthly cash payments to ensure a regular income after retirement. Unlike a Life Insurance policy, which provides financial stability for a family after the insured breadwinner dies, the savings from a retirement plan benefits the member of the annuity when they withdraw from an active working life one day.

In essence, it is a tax-efficient investment that allows the member to live comfortably in their senior years. It’s worth noting that the South African Revenue Service (SARS) has amended the retirement fund tax laws, which came into effect on 1 March 2016. Investors contributing to an RA are now eligible for a tax deduction of up to 27,5% of their taxable income (to a maximum of R350,000 per year), taking into consideration the total of contributions you made to the funds for the year.

Like any major financial decision, it is imperative that investors do their homework in terms of the type of plan and RA provider they choose. Not carefully weighing the options before deciding can have a significant impact on their returns, therefore it’s important to consult with a financial advisor before moving forward.

Investors need to be especially vigilant about the cost of managing their retirement annuity. “Given the dramatic long-term impact of fees, you should ideally pay less than 1% per annum for these services. Many RAs (especially the underwritten ones) can cost more than three times the low-cost alternative. Over a forty-year savings term, lower fees could double your pension,” advises Tracy Jensen, Chief Product Architect at 10X.

Why you should contribute to a retirement annuity?

Statistics released by the Reserve Bank in 2015 indicate that South Africans are not very good at saving. Back then, South Africa could only manage to save 15.4% of its GDP in the form of pension contributions and other investments. As it currently stands, there has not been much improvement in the uptake of long-term savings. According to the 2017 Old Mutual’s Savings and Investment Monitor, around 30% of those polled in the study, belong to a retirement annuity. Another study, the Momentum/Unisa Household Financial Wellness Index 2017, has uncovered that only 24.2% of financially well off individuals agree that they are able to make provision for retirement.

As medical treatments and public health consciousness continue to improve, people are now living longer and thus require more savings to, amongst others:

- Secure a comfortable living standard in their senior years

- Cover any unforeseen expenses in retirement

- Lessen their dependence on family and social grants

- Supplement their pension fund

- Enjoy tax free investment returns and lump sums

With the new tax legislation outlined on SARS’ website, investors may upon retirement withdraw one third of their savings as a lump sum. Any lump sum withdrawn at retirement above a minimum threshold (currently R25 000) is subject to tax. The remaining two thirds of the retirement annuity is received in the form of an annuity (regular pension). If the income from your annuity exceeds the tax threshold, tax is payable on the amount. Click here for the current thresholds.

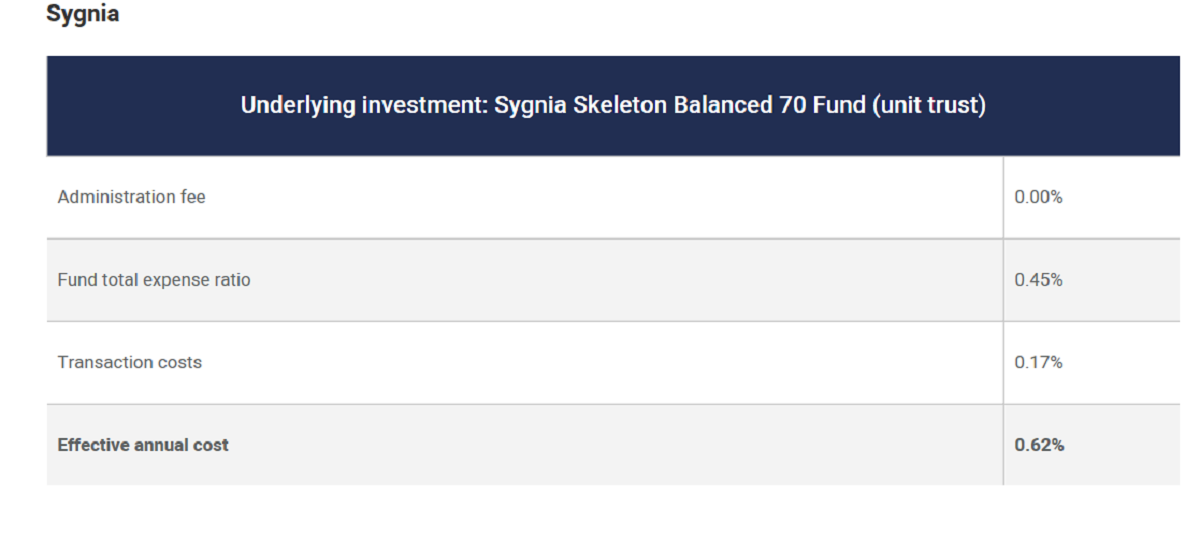

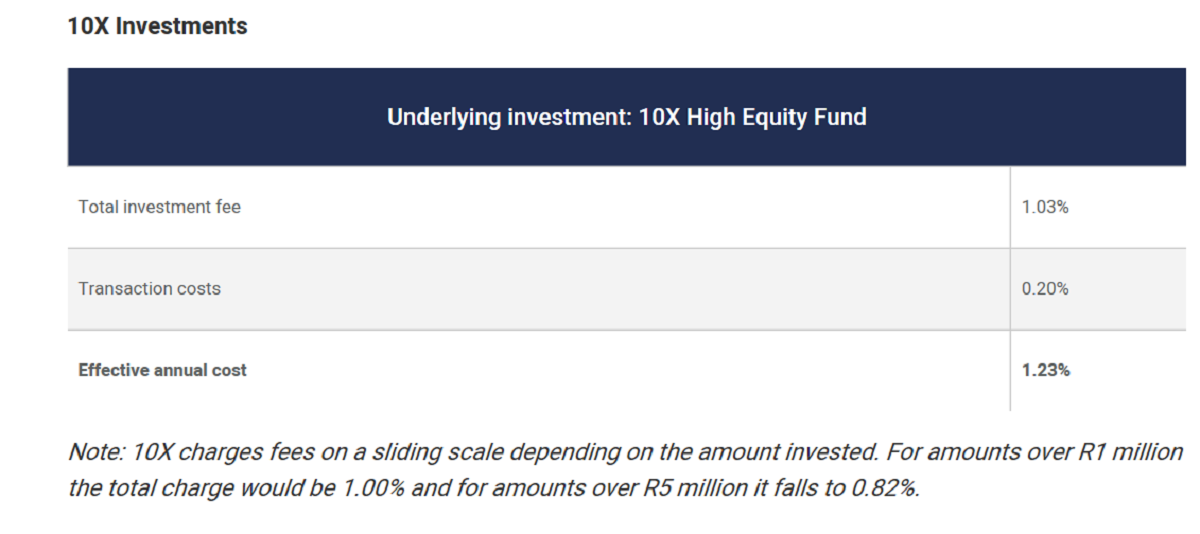

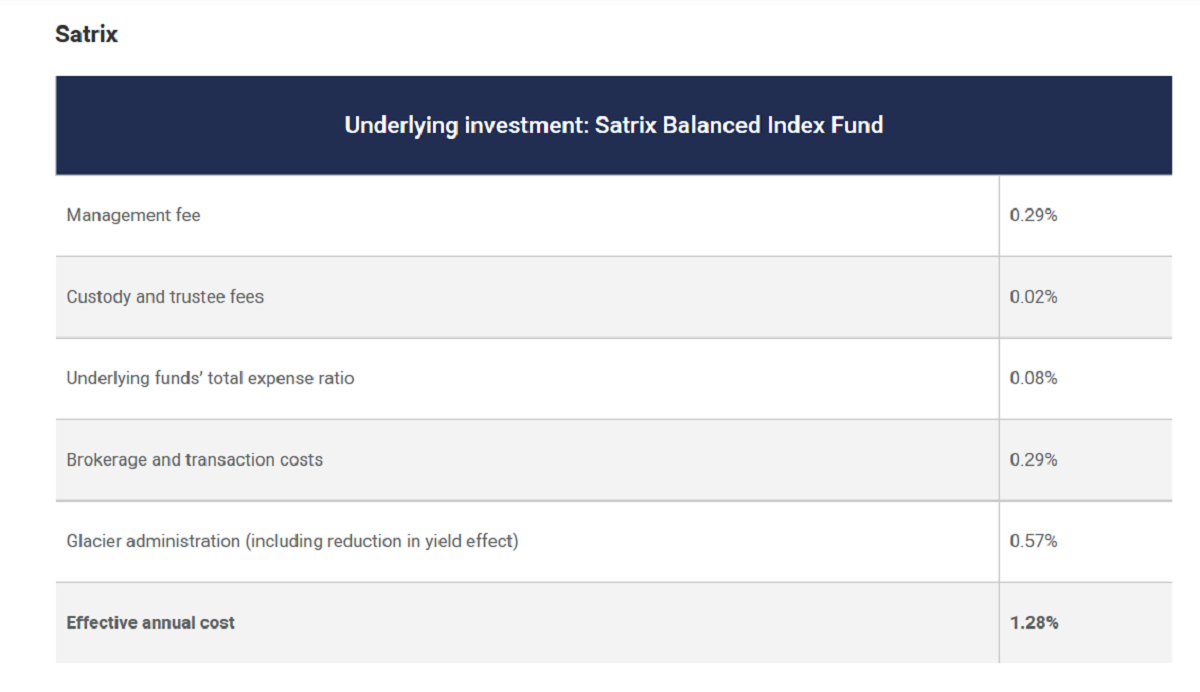

It’s up to the investor to choose a provider and retirement plan that suits their needs, however, as noted above, the lower your investment fees the higher your gains could be. Using the industry’s Effective Annual Cost (EAC) standard, which requires complete disclosure of fees related to investments, Moneyweb was able to compile a list of the most cost-effective retirement plans in South Africa. Below are the top three:

“The Sygnia Skeleton Balanced 70 Fund is a multi-asset-class fund managed with a high exposure to equities in order to seek strong long-term returns. The fund will have exposure to both domestic and foreign assets, which will include equities, fixed interest and money market assets, and will comprise a number of underlying portfolios predominantly managed on a passive, index-tracking, basis.” (Source: Sygnia)

“The 10X Prime High Equity Fund is a simple, low cost unit trust. It is suitable for long-term investors (horizon of 5+ years) who want to diversify their exposure across different asset classes. Over shorter time horizons the returns may be volatile.

Investors will obtain exposure to the 60 largest shares listed on the JSE, over 7,000 of the largest international shares, some of the largest local property shares, interest-earning local investments, local cash and offshore currency.” (Source: 10X)

“The Satrix Balanced Index Fund is suitable for long-term retirement savings and offers diversified exposure to all the key local and international asset classes, with a smart SA equity (shares) core. The fund tracks a composite index, with a long-term strategic asset allocation. This fund is best suited to investors with at least a medium-term investment horizon (3-5 years). For more information contact your financial adviser or broker.” (Source: Sanlam Investments)

For the sake of the analysis, Moneyweb considered an investment amount of R500 000. Each product was weighed under company’s own high equity Regulation 28-compliant portfolio and the results reflected the latest available expense ratios.

While Sygnia, 10X Investments and Satrix came out top, the author noted that the retirement plans offered by Allan Gray and Coronation are significantly competitive with them. Allan Gray’s Balanced Fund boasts an effective annual cost of 1.62% while Coronation’s Balanced Plus Fund effective annual cost comes in at 1.80%. Read the complete analysis for other low-cost retirement annuities in South Africa.

DISCLAIMER

Hippo.co.za has made the above article available as an information source only and should not be construed as financial advice. Readers are encouraged to discuss their options with a financial advisor to determine what is the best retirement annuity for them.

Hippo Blog Categories