About Us

Get ready for a game-changing range of comprehensive and affordable life insurance solutions designed to protect you and your loved ones. From life,funeral, and disability cover to exciting benefits that help you manage your health, we’ve got you covered every step of the way! Plus,we’re introducing new and exclusive education and chronic illness cover. At Dis-Chem Life, we’re redefining peace of mind with all-in-one protection that rewards you for living well. Join us today and secure a brighter future!

Plus, as an extraRewards member earn discounts of up to 100% on your daily must-haves at Dis-Chem stores.*

Choose OneSpark because:

- Automatic cover for spouse & 3 children

- R5,000 Airtime & Data Benefit

- Immediate Accidental Cover

- Cover for up to 21 people

- No hidden fees, no medicals

- Claims paid from 4 - 48 hours

Global giants in our corner who guarantee your coverage. We are underwritten by Guardrisk Life Limited who has over 25 years insurance experience and who is a member of Momentum Metropolitan Holdings company, one of South Africa's largest and most trusted insurers.

We care about our customers more than anything else, that's why we're rated 4.9 out of 5 on Google.

Join the tens of thousands of happy clients

Affordable prices!

OneSpark clients are saving up to R2 500 on their funeral cover premiums compared to other insurers every year!*

That's because we don't have bloated expenses, archaic systems and old, grumpy products like other insurers. We use smart tech and world first innovations to give you real value at really affordable prices.

Select from a range of products to suit your needs

You can take out anyone of our plans individually or add them together for more comprehensive family protection.

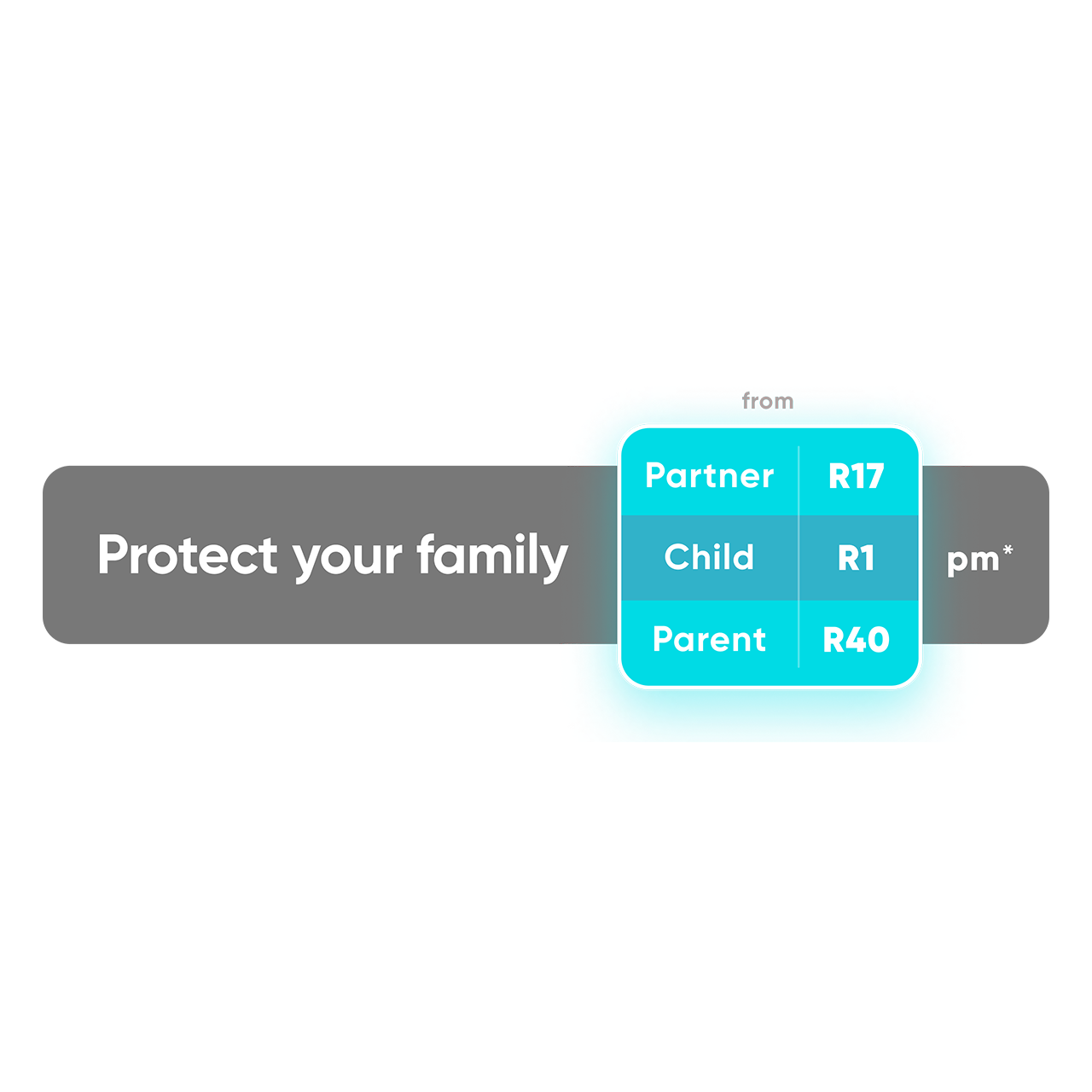

- Funeral Plan: Flexible funeral cover for you and your family that you can tailor to suit your needs and your budget. Up to R70 000 cover, from only R75 per month*

- Add Grocery, Transport, Daily Expense and Education protection to get an extra R165 000 life cover and massive in cash payouts!

- AI powered Life Insurance:

Up to R10 million life with some clever tech and award-winning innovations. The world’s most advanced life insurance product that’s instant, smart, easy, and can save you up to 50%, today.

OneSpark is an authorised financial services provider, FSP 50594. Our products are underwritten by Guardrisk Life Limited, an authorised FSP 76 and a licensed Life Insurer.

*Premium comparisons were done on a like-for-like basis against major insurers, where the premiums were taken from publicly available online sources as at 1 January 2022. Terms and conditions apply. Premiums are risk profile dependant, guaranteed for 12 months and subject to change. The cash payout are automatically included in the premium, and are paid out at the cash payout date if the policy is still active, no claims have been made and all policy premiums have been paid. The present values of the cash payous are: Daily Expenses: R460,000, Education: R150,000 , Grocery: R60,000 and Transport: R240,000. 1 Grocery, 1 Transport, 1 Daily Expense and 3 Education policies needed to get full R165 000. Award won at Wealth & Finance International in 2021. For the full policy terms and conditions, including key limitations, exclusions, risks and charges, please visit www.onespark.co.za.