Five Money Mistakes to Avoid

There are certain money mistakes that can cost you for the rest of your life, such as taking on too much debt or failing to save enough for your retirement. Ensure you remain financially stable by avoiding the following five money mistakes from a list compiled by three financial advisors who work with people and their money every single day: Sue Torr, the managing director of Crue Invest, a financial planning consultancy in Cape Town; Peter Hewett, the 2014 Financial Planner of the Year and managing director of Hewett Wealth in Johannesburg; and Gareth Leonard, a wealth manager at Netto Invest, as published in the Personal Finance section of IOL.

1. Not insuring your greatest asset

According to Torr, this is not your home or car, but your ability to generate an income. If you were to lose your income it could be a challenge to meet your current living expenses, let alone save for your retirement she says. “Until you have accumulated sufficient assets, the importance of an income protection benefit cannot be overstated. You might think the chances of becoming completely disabled are slim, but the truth is that an income protection benefit is designed to protect you in the event of a temporary disability too.”

Leonard adds that people don’t imagine finding themselves disabled or suffering an early death. Although you may be a very cautious person, you are still at a risk of being injured because of someone else’s recklessness. It’s essential that you take out both life cover and disability cover as soon as you have dependents who rely on your income, he says.

2. Investing too moderately

Leonard points out that “being too conservative in your investment strategy can severely deplete the potential of your retirement savings”. He says that while there is a great deal of comfort in not having the capital value of your investment moving up or down on a daily basis, without a degree of risk, returns that could have been achieved are forfeited, resulting in a smaller retirement fund at retirement age. Leonard adds that retirement projections indicate that you need to save more to make up for low returns on investment, leaving you with less disposable income for the rest of your working career.

As a rule of thumb to keep you on track for your retirement goals, it is recommended that you weigh your current retirement savings against your current salary. If working for ten years, your savings target should be twice your current annual salary, five times when working for twenty years, ten times when working for thirty years and sixteen times your final salary at retirement (working for forty years).

3. Overspending for a wedding

Torr says one of the worst mistakes a couple can make is to go into debt to pay for a dream wedding. Due to soaring costs and expectations, couples are starting their lives at a very big disadvantage she says. “A total bill of R250 000 is not unusual, but that’s the equivalent of a 10-percent deposit on a R2.5-million home.” She advises that couples should save for their wedding, choose a more affordable option, and reduce numbers to close friends and family. Whatever you do, you should not risk being burdened with debt when you start married life.

4. Depleting your retirement savings

Failing to preserve your retirement savings when you move from one job to another is possibly one of the most common mistakes people make, says Leonard. While anyone would be tempted to use the funds when there is a pressing need such as buying a new car, or going on a well-deserved holiday, “the problem with withdrawing the money and spending it is that it is not only the lump sum that is lost forever, but all the potential capital growth over the remaining years to retirement – and that can never be replaced,” he says.

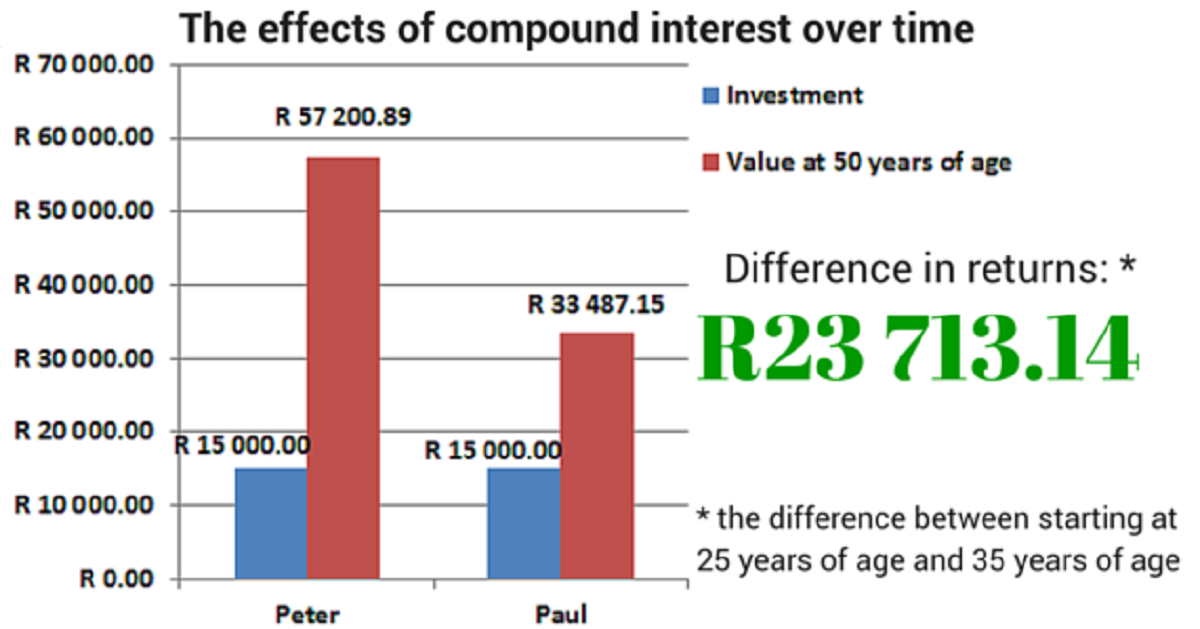

Another similar mistake people make is failing to save for retirement early enough. According to Hewett, it is vital to contribute to your employer’s retirement scheme, or your own retirement annuity (RA), at the maximum affordable level (but no less than 15 percent of your salary a year) from when you receive your very first salary. If you consistently contribute towards retirement savings throughout your entire career, you will be in a far better financial standing than someone who starts saving only later on in their career, as shown in the below graph.

5. Having no medical cover

Due to the increasing cost of medical cover, Hewett says many people never join a Medical Aid scheme or withdraw their membership, on the grounds of affordability, “leaving themselves open to financial ruin in the event of a serious health condition or accident”. As an alternative to a costly medical scheme cover, he advises people to opt for the many hospital plans offered by reputable medical schemes, taking into account the prescribed minimum benefits required by law and adding so-called “gap cover”. That way, he says, you can get a good cover that is reasonably affordable.

Torr adds that “even an operation as simple as a tonsillectomy or hernia operation can result in thousands of rands in out-of-pocket expenses. Without a Gap Cover policy in place, many people are forced to take out a loan or deplete their emergency funding to cover their medical bills,” she says.

DISCLAIMER: This article is for informational purposes only and should not be construed as financial advice.

Hippo Blog Categories