What to Do if Your Medical Aid Savings Account is Already Empty

It's pretty depressing when your medical savings account (MSA) runs out before the end of the year. It happens for many of us around the halfway mark, but sometimes you may have used up your savings in January. It can happen quickly if you need dental work done or need a new pair of prescription glasses.

If this happens to you every year, what do you do? How do you get through financially for the rest of the year? Before we get to that, let's look at what an MSA is and how it works.

💰 What is a MSA?

Medical Savings Account

A medical savings account is an amount of money that’s put aside for you by the medical scheme. You pay towards it in your monthly premiums in addition to your risk premium and the full amount is made available at the beginning of the year. This money belongs to you, but you can't withdraw it for cash—it's strictly to be used for medical expenses. The medical scheme oversees its use and you can only pay for things as approved by the scheme. It’s used mostly for day-to-day medical costs and some procedures and scans.

If you want to use it all up in one go, that's your choice. Although this could see you struggling to pay other unexpected medical expenses throughout the rest of the year.

You could also use it to pay for chronic medication every month or when you need to see the GP. It's entirely up to you.

But, if you use it all before the end of the year and decide to switch medical schemes or plans, you'll need to pay back the months yet to pass, where the scheme fronted you the money—a prorated amount.

If you have a positive balance at year-end, the remaining amount rolls over into the next year's savings pot. If you change schemes, the medical aid is obliged to pay you that money back. That's the only time you can withdraw it for cash. But don't expect it back immediately—many schemes have policies that make you wait a few months before they pay out.

💸 What Happens If My MSA Runs Out Before the End of the Year?

This depends on whether you have an above-threshold benefit. If you do, then you keep submitting claims to your medical aid scheme so it can record how much you're spending from your pocket. Usually, there's a fixed amount you must pay for yourself before reaching your above-threshold benefit. Once you've hit that threshold, the medical aid will start paying out for certain events, like GP visits, again.

If you don't have one of these, the bad news is that you need to pay your own medical bills for the rest of the year. 😭

We recommend still submitting all your claims to your medical aid, though, because you can get some money back in tax credits by doing this. If you have medical aid through the company where you work, these tax credits are applied through your employer monthly. Every cent helps!

🏥 Does My MSA Affect My Hospital Benefits?

No, your hospital benefits are completely separate from your savings and day-to-day benefits. This means you don't need to worry about paying for hospital expenses if your MSA runs out.

💊 What About My Chronic Conditions?

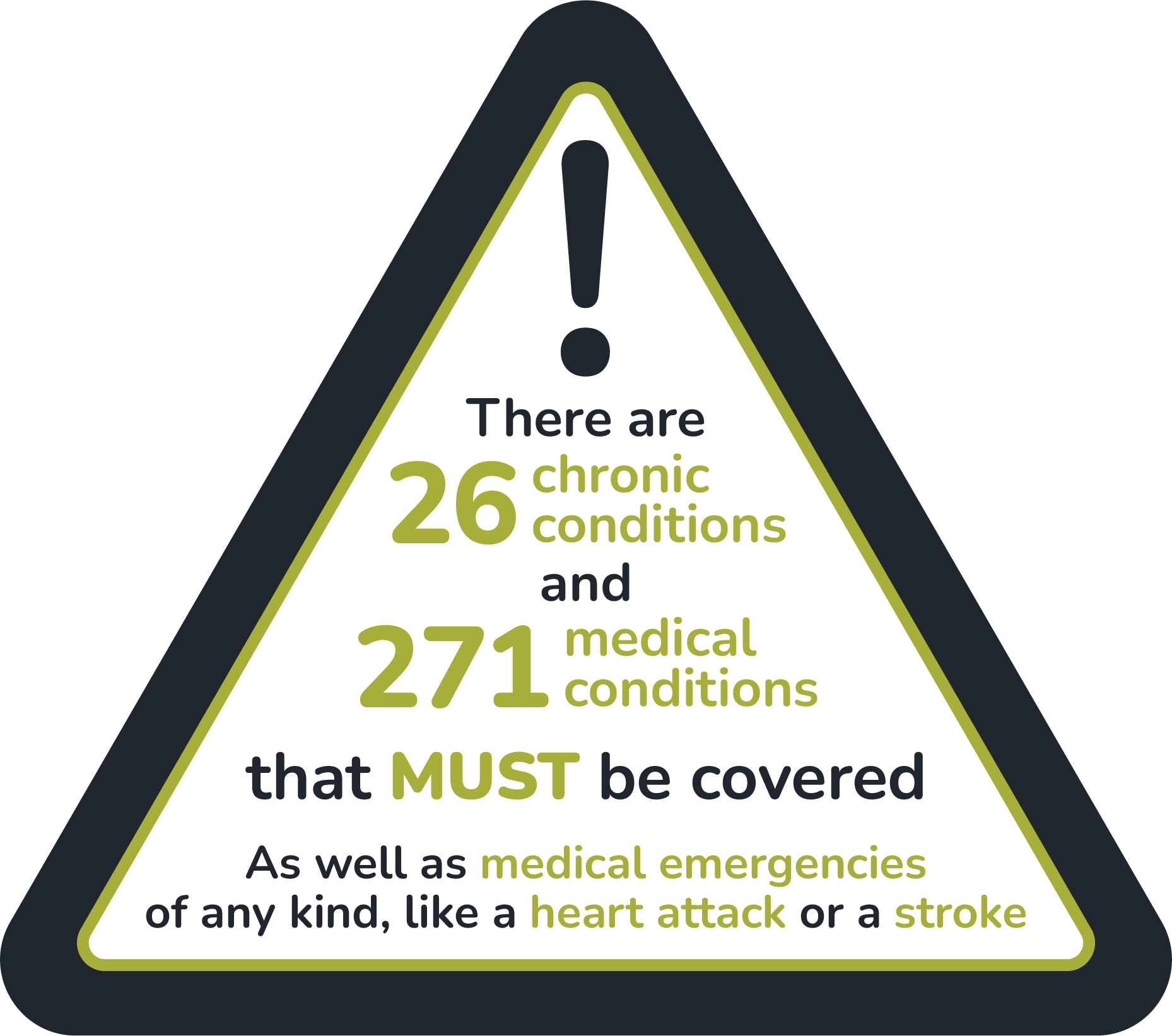

Chronic medicine benefits work a little differently. Every medical aid in South Africa must cover certain chronic conditions and provide for a specific list of prescribed minimum benefits—even on hospital plans.

🏋️♀️ How Do I Make My MSA Stretch Further in Future?

If you're tired of ending up with nothing mid-year, here are some ideas on how to make it stretch further next year:

Don't use your MSA to pay for over-the-counter medicines. These can add up so quickly—vitamins here, cough medicine there, and before you know it, your MSA is dry.

Use generic medicines. Discuss with your doctor if there's anything more affordable that's just as effective for your condition or illness.

Find a doctor with lower rates. If you’re on a network plan, a network GP will also make your savings last longer.

Apply for your chronic conditions to be covered. Get your doctor to fill in the forms and submit them to the medical scheme.

Use the plan's preventative benefits. Many medical aids offer benefits for things like flu vaccines and pap smears, which can help prevent you from becoming sicker later.

🔁 Switching Plans

If, no matter how you try, the MSA is just not enough, then it's time to consider moving onto a plan that either pays a larger portion of your medical scheme contribution towards your MSA, or you pay a little extra every month for a better one.

Remember, though, that you can't just change plans and schemes any ol' time. Usually, medical aids won't let you upgrade your plan during the year (although most are happy to let you downgrade). And switching mid-year between schemes might mean waiting periods.

😷 Types of Plans

If you've decided to compare different plans, we can help you with that. At Hippo, you can compare 10 medical aid providers in just a few minutes.

Hippo Blog Categories