Smart money-saving tips: how to save money on Medical Aid, Insurance and Loans

Are price hikes putting a dent in your bank balance? Here are some smart money-saving tips to fight the effects of inflation and keep your budget in the black.

The rising cost of living in South Africa: Why are things getting more expensive?

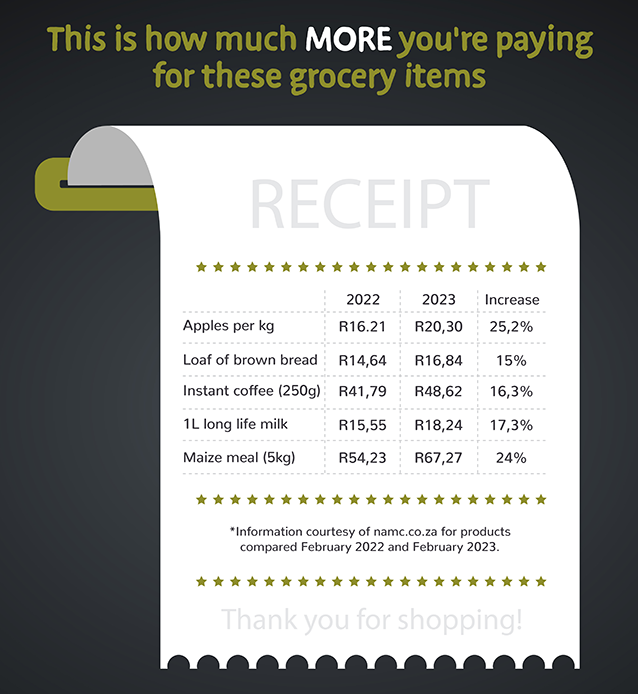

Have you noticed that your monthly budget isn't covering what it used to? The cost of living in South Africa is rising, and this is thanks to inflation: an increase in food, fuel, and electricity prices. The inflation rate is measured via the Consumer Price Index (CPI), which tracks changes in prices over time on various goods and services purchased by most South Africans — anything from bread and milk, to clothing, education and even insurance and financial services.

Read more: Tick these boxes in your 20s, 30s and 40s to enjoy a richer retirement

3 Smart money-saving tips to help you spend less on Medical Aid, Insurance and Loan repayments

There are many ways to cut costs but the easiest place to start is by using Hippo to review your monthly debit orders to see if you're paying more than you have to on things like Insurance, Personal Loans and Medical Aid. Here's where to start...

1. How to save money on your Medical Aid plan

Consider downgrading to a lower plan, such as a hospital plan, with the option of topping up with Gap Cover so you save money but still have coverage. Alternatively, compare your current plan to a network plan, which may be cheaper. A network plan means you may need to use the medical facilities prescribed by the scheme for elective procedure admissions or make a co-payment when using a hospital outside the network. "The network rules only apply to planned procedures, so if you need an emergency admission, you can still be admitted to any private hospital," explains Alexia Graham, Director at Hippo Advisory Services. Alexia Graham, Director at Hippo Advisory Services. Avoid simply going for the cheapest option that may not cover your needs; make sure to compare plans across schemes so you can find the best value.

Feeling a bit overwhelmed? Hippo can help you find the right Medical Aid cover for your budget.

2. Review your insurance policies regularly to save on expenses

Want to know how to save on insurance? Many financial advisors recommend that you check your insurance policies once a year (although we at Hippo suggest doing it more often than that!).

- Life happens, and our circumstances change, so what you needed last year may not be what you need today. Perhaps you're insured for items or circumstances that are no longer a priority, and you're making unnecessary payments?

- If you have insurance policies with different companies, consider asking each what they would charge to transfer all policies to one company, as you may receive a discount.

- For Vehicle Insurance, consider increasing your excess amount, which should reduce your monthly payments.

- Another tip is to simply talk to your insurer. Tell them what you can afford to pay, and they may be able to help you structure an insurance product that suits your needs and budget.

- Finally, shop around for comparable insurance at different companies. You may find the same product at a cheaper cost.

3. Re-evaluate how you're paying off your personal loans or debt

We all know that paying more than the required minimum helps us repay our Personal Loans faster. But what if you're really struggling to meet even the minimum repayment amount? One option is to take out a Debt Consolidation Loan so you could pay off one or more of your loans, and which may have a lower interest rate and minimum monthly payment. This is especially effective if you're paying off multiple debts, such as store cards.

What is inflation and why is it happening?

Why is inflation happening? There are no simple answers, but Eskom's loadshedding, the war between Russia and Ukraine, and the aftershocks of the Covid-19 pandemic are all taking a toll on our economy. According to Statistics SA, South Africans are experiencing some of the biggest annual price increases since 2009. Inflation for food and non-alcoholic beverages has soared, with prices increasing by 14% in the 12 months to March. Thankfully we're not experiencing hyperinflation, which is when prices rise by 50% or more from month to month.

Foods that have gone up in price the most include milk, eggs, cheese, sugar, sweets, desserts, fruit and vegetables, however other food items, as well as education, petrol, appliances and rentals, also went up. Suffice it to say, South Africans are feeling the pinch, since few are receiving income bumps to offset these escalating living expenses, which means we are becoming poorer.

What are South Africans spending their money on?

While we're clearly all getting poorer, where exactly is our money going? A report released by South Africa's biggest digital bank, Capitec, which has access to the financial data of roughly a third of all South Africans, found that we are spending 8% more on groceries and 16% more on fuel, yet "the increase in spend on groceries was tempered by the effect of clients buying more affordable products". We're certainly not spending more because we're earning more; the average increase in Capitec client income was only 4%.

But that's not all... Globally, banks have been sharply increasing interest rates in order to offset the effects of inflation. This means it costs more to borrow money, and the cost of existing loan repayments is rising. So, how does this influence inflation? The idea is that if our loan repayments increase, or it becomes harder to access credit, we (consumers) will spend less, decreasing the demand for goods and services. And when demand decreases, prices stabilise in turn, thereby reducing inflation. This may be why Capitec reports that the value of the average loan debit order increased by 20%, and the average vehicle finance debit order grew by 15%.

Where to from here?

While the cost of pretty much everything is going up, our salaries just aren't. But by adopting simple money-saving strategies and comparing deals on Hippo.co.za, you can #SaveYourSalary and put some of your hard-earned cash back in your pocket. Ka-ching!

This article is for informational purposes only and should not be construed as financial, legal or medical advice.

Hippo Blog Categories