5 Reasons Why Cancelling Your Car Insurance Is a Bad Idea

It’s tough out here. Petrol prices, interest rates and food price hikes have put us all in the grips of a cost-of-living crisis. Everyone is looking at ways to reign in the budget and cancelling their car insurance is one of those ways.

We get it – paying car insurance can feel like a grudge purchase, especially if you’ve never needed to claim for anything.

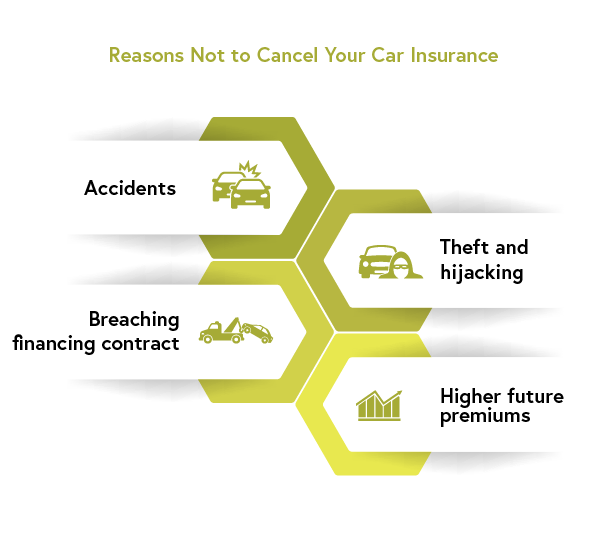

But hold on before you make a hasty decision you might regret. Canceling your car insurance is a risky move that could end up making your financial situation much worse. Here’s why cancelling your car insurance is a bad idea:

#5 Your bank won’t allow it

One big reason not to cancel your car insurance is that you might not be allowed to.

If your car is financed by a bank or lender, your contract may require that you have it comprehensively insured throughout your loan term. Cancelling your insurance is a breach of contract and can result in your insurance being cancelled.

#4 Accidents

You can cancel your car insurance, but unfortunately you can’t cancel the possibility of an accident.

Even if you rate yourself a good driver, you don’t have control over what other people do on the road. If you’re involved in a crash— big or small —you could find yourself footing the bill not only for your car but for the other person’s, too.

Having to fork out for car repairs or a new vehicle when you’re already financially strained can be catastrophic.

#3 Theft

South Africa is lekker. But it’s also full of crime. The latest available SAPS annual crime stats (2022/3) show carjacking was at an all-time high – with 22 702 vehicles hijacked in a single year. 37 461 vehicles were reported stolen that same year. That’s about 165 incidents a day!

If your car gets taken and you don’t have insurance, that’s it kanti. Unless you have savings for a new car or a rich uncle or tannie to help you out, you’re officially without wheels now.

Worse still, if your financed car gets stolen or hijacked and you don’t have insurance, you’ll be stuck paying off a vehicle loan for a car you don’t have.

Imagine that on top of your existing financial stresses?

#2 Maintain your good rating and cheaper premiums

Cancelling your insurance and the resulting uninsured period on your track record can mean higher premiums when you want to take insurance out in the future.

Insurance companies base the cost of premiums on several factors, including your risk profile – the higher risk you are, the higher your premium.

A gap in your insurance could mean that you drove uninsured, which they take as a sign that you’re willing to take risks. It also shows you’re financially unstable, which means there’s a higher chance that you’ll miss future payments.

#1 Why cancel when you can get cheaper?

If you’re thinking about cancelling your insurance because it’s too expensive, consider rather switching up your policy to a more affordable option (if your finance contract allows it).

But the best option of all is to shop around for a better deal. Not only will you pay less each month, but you’ll keep the same level of cover you enjoyed previously – maybe even more!

Hippo.co.za makes looking for car insurance easy by giving you 110 side-by-side quotes from some of South Africa’s top car insurers.

That way you can compare and choose the coverage that best suits your budget.

Use our free online comparison tool to find and compare the cheapest car insurance quotes, and get a no-obligation quote today.

Hippo Blog Categories