Car Modifications: Will They Affect Your Car Insurance?

Many car owners choose to put their own stamp on their new set of wheels. Some may go to extreme lengths to make their car stand out on the road as seen in the popular television show Pimp My Ride, while others may make a few tweaks here and there. They may add modifications to enhance the performance of the car or simply to do cosmetic upgrades. Even used-car shoppers will likely come across a car with custom parts installed.

If you’re considering personalising your car, regardless of your reason, you first need to determine if they could potentially get you into trouble. Modifications deemed valid include manufacturer approved accessories that will not have an impact on the the warranty of vehicles. Other modifications, such as speed enhancement, pose a road safety risk and may be considered ‘illegal’ by certain authorities. The Cape Town Traffic Department made national headlines in 2015 after pulling modified vehicles from the road and subjecting them to a roadworthy process.

It is also important to know that these enhancements may affect the price you pay for Car Insurance. While policies will differ between individual insurance companies, the insurer may view certain modifications as a higher accident or theft risk, or as additions that could enhance the value of your car making it more costly to replace. Below is a breakdown of some of the most popular car modifications as well as the level of insurance risk associated with them.

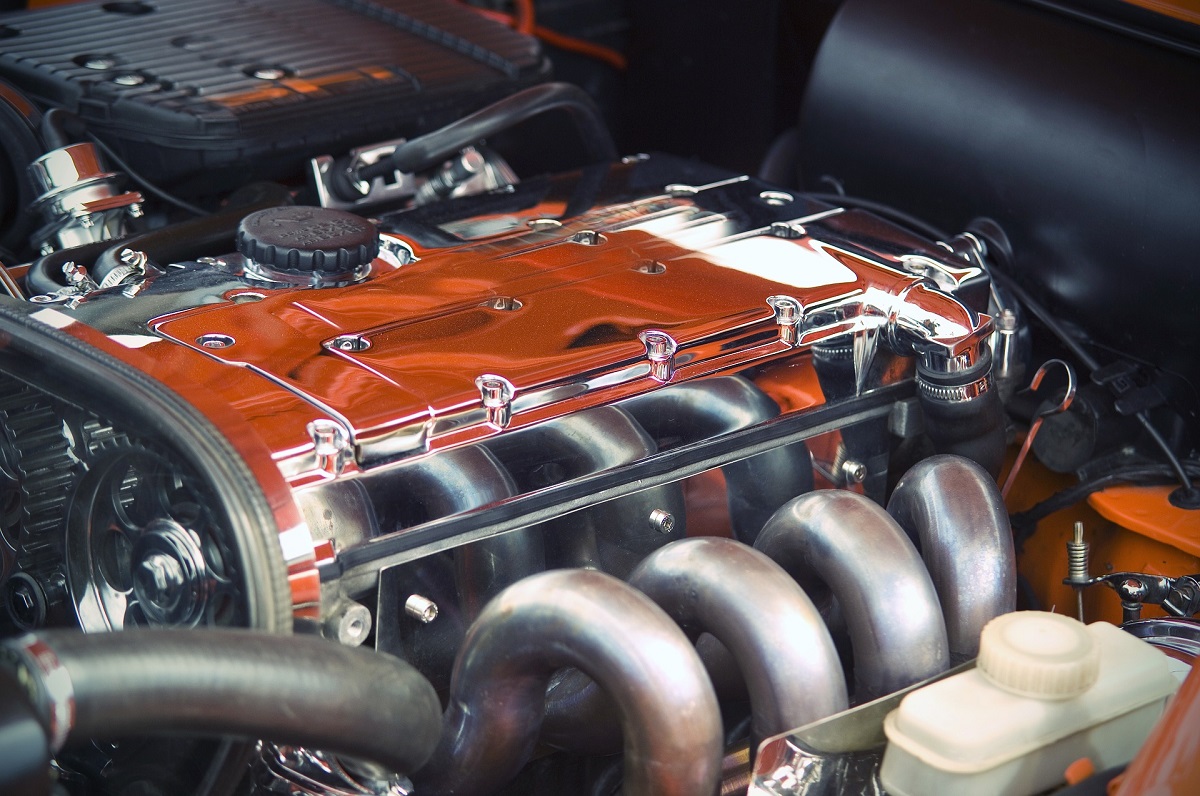

Engine modifications

If you’re looking to modify the engine or exhaust system to maximise the performance and speed of your vehicle, you may pay a higher premium since higher horse power poses a greater risk of accidents.

Aftermarket tyres

Larger rims or high-performance tyres may respond better to your driving input than standard tyres, and may improve the way your car handles the road, however, if these are not fitted correctly they may affect the car’s ability to turn or swerve effectively.

Customised paint jobs

While a custom paint job such as elaborate patterns, racing designs or colour shifting paint, will be visually appealing to yourself or others, specialist paint work may actually increase your premium as it may be costly to repaint the vehicle to match the original design.

Accessories

Audio system upgrades and other interior accessories such as Bluetooth and GPS devices, not only push up the value of your car but can also make it more attractive to thieves.

Tinted windows

Tinted windows can block the sun's harmful ultraviolet rays from entering your car, reduce the heat inside, and protect your personal privacy. But, there’s a downside to covering your windows: it can reduce your vision if the film is too dark. Car Insurance companies regard the so called `limo’ tint as a safety hazard while the law requires a 35% visible light transmission on all windows of vehicles, other than windscreens, and a 70% visible light transmission on windscreens.

Replacement of seats

Removing and replacing interior upholstery, such as installing sport seats, can alter the weight and handling of your vehicle, and may cause your insurance company to review your premiums.

Parking sensors

While many new cars are pre-equipped with parking sensors, adding them to an older car may be a good way to decrease your insurance premium, as they can help you safely park and avoid damage to other vehicles.

Anti-theft devices

Vehicle tracking systems, electronic immobilisers, hood-locks and gear locks are a few of the aftermarket anti-theft devices that significantly reduce your chances of becoming a target of theft and could earn you a discounted insurance premium rate.

Spoilers

A spoiler is meant to give your car a better grip on the road and maintain traction at high speeds. As such, it will be more difficult to negotiate a lower Car Insurance if you have attached a spoiler on the back of your car. This is due to the impression that drivers who use spoilers may be more inclined to drive faster.

When it comes to car modifications and insurance, honesty is the best policy. When you take out Car Insurance, the carrier will ask you if your car has been altered in any way from the original specification stipulated by the manufacturer. If your car is already covered,update your policy with modifications made after insurance was taken out. If you’ve purchased a modified used car and need to insure it, declare all improvements made to find out if they will impact your policy. Should you not be forthcoming with your insurer, any claims made in the future could be rejected or the coverage paid for losses could be significantly lower.

DISCLAIMER: Vehicles, their makes, models and brands, used in the above images are for illustrative purposes only and does not reflect Hippo.co.za’s endorsement of them. This article was made available as an information source only and should not be construed as financial/automotive advice. It is advised that you consult your broker or insurer to best understand how modifications may affect your Car Insurance premiums.

Hippo Blog Categories