The Difference Between Car Insurance and a Motor Warranty

When you're in the market to purchase a vehicle, you can expect that there will be consumer protection plans attached to cover the vehicle against certain risks. The two most common plans are Car Insurance and a Motor Warranty. The first is offered by insurance companies and the latter by the vehicle manufacturer, although insurance providers also sell variations of Motor Warranties.

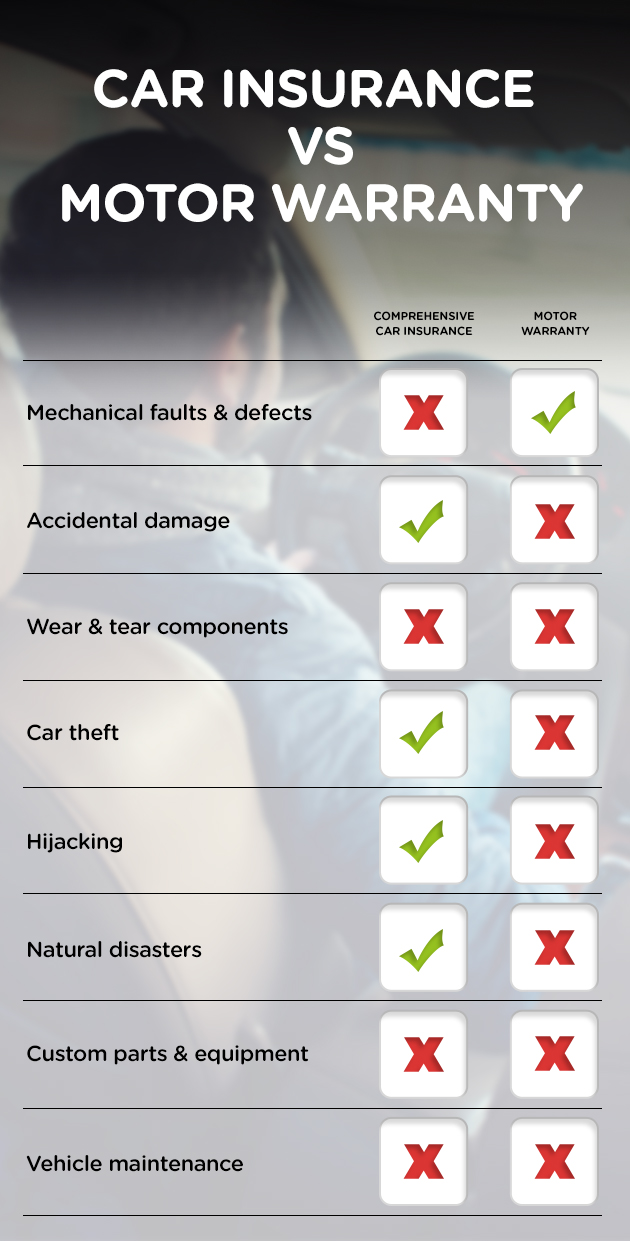

It's easy to assume a Car Insurance policy and a Motor Warranty are the same. While each product is meant to protect you and/or your car and can overlap under certain circumstances, they are actually very different things. This blog article explains what Car Insurance and Motor Warranties cover.

The mechanics of a Car Insurance policy

A Car Insurance policy, for which you pay monthly premiums, is a plan you can take out as soon as you become the owner of a car. It covers repairs under specific conditions, usually when you have been involved in a car accident. Depending on the type of insurance (see below), the policy can also provide financial cover in the event of theft, hijacking or fire.

Most insurance companies offer tailor-made Car Insurance policies of which Comprehensive, Third Party Only, and Third Party, Fire and Theft are the basic options. It's important to consider how each will suit your particular needs and circumstances. Payment terms and claim procedures vary with each company as does the monthly premiums for each type of insurance.

- Comprehensive Insurance – offers the highest level of protection and provides cover for most risks to your vehicle including accidents, fire, fire theft, hijacking and damage to other parties.

- Third Party Only Insurance – if you are liable for an accident, this type of insurance pays for the damage to other parties and their vehicle/property.

- Third Party Fire and Theft Car Insurance – this plan extends beyond liability cover to include theft and damage as a result of fire and hijacking.

The nuts and bolts of a Motor Warranty

A Motor Warranty is a written promise from the manufacturer or a Car Insurance provider that your car parts will last for the length of time they are supposed to. If a part of your car malfunctions due to no fault of your own, you are entitled to have it repaired or replaced at no extra cost as prescribed by your warranty.

According to the AA, most new vehicles come with some kind of warranty that expires after a certain date or after a specific mileage has been reached. Common parts that fall under the warranty are the engine, gearbox, electric components, fuel system, audio system, and sensors. A Motor Warranty excludes general wear and tear items and damage as a result of negligence.

-

Pre-Owned Warranty

– this plan is suited for cars whose manufacturer warranties have expired. An insurance company will offer this type of warranty, covering repair and/or replacement of components, specifically listed under the respective policy’s specifications. -

Extended Warranty

– In addition to the standard warranty on your new passenger car or if your current manufacturer warranty has expired, you can also take up an Extended Warranty to protect your car against the expenses of mechanical breakdowns. This type of warranty expands the years and mileage originally provided for by the manufacturer.

What is the difference between Car Insurance and a Motor Warranty?

A Motor Warranty is not the same as Car Insurance purely because the former gives special importance to the liability of the manufacturer in ensuring the good condition of your car. Thus, if factory faults or defects cause a mechanical breakdown, the manufacturer or insurance company's warranty entitles you to replacements or repairs under that warranty plan.

If you are at fault for the damage to someone else's car, Car Insurance will provide protection against financial losses suffered. If your car is damaged as a result of an accident, theft or natural disaster, a Comprehensive Car Insurance policy will help pay for expenses related to repair and/ or replacement.

Should you have both?

While the manufacturer's warranty usually comes standard on a new vehicle and expires after a certain number of years, you can let Car Insurance and an Extended Warranty/Pre-Owned Warranty supplement one another. For example, if your brakes fail and you crash into the back of another vehicle, the warranty would cover the brakes and insurance may take care of the damage, provided you have the necessary cover.

Do note that no policies and warranties are created equal so it's best to check with your insurance company or car dealership, or compare quotes to find the best deal.

DISCLAIMER: This article is provided for informational purposes only and should not be construed as advice. Hippo.co.za cannot be held liable for loss and damages that arise as a result of this article.

Hippo Blog Categories