If one of your resolutions for 2026 is to be more on top of your finances, here’s a simple place to start: your insurance. New comparison data shows that South Africans are saving an average of R1208 per month* by reviewing and switching their insurance cover - not because they’re opting for less protection, but because they’re better informed.

Hours after a parent, spouse or child passes away, you’re hit with the reality of making the funeral arrangements – a task you may not have hands-on experience with. You may have attended dozens of funerals before and already know the rituals that take place during the burial, but how do you pull it all together yourself considering all the challenges and decisions?

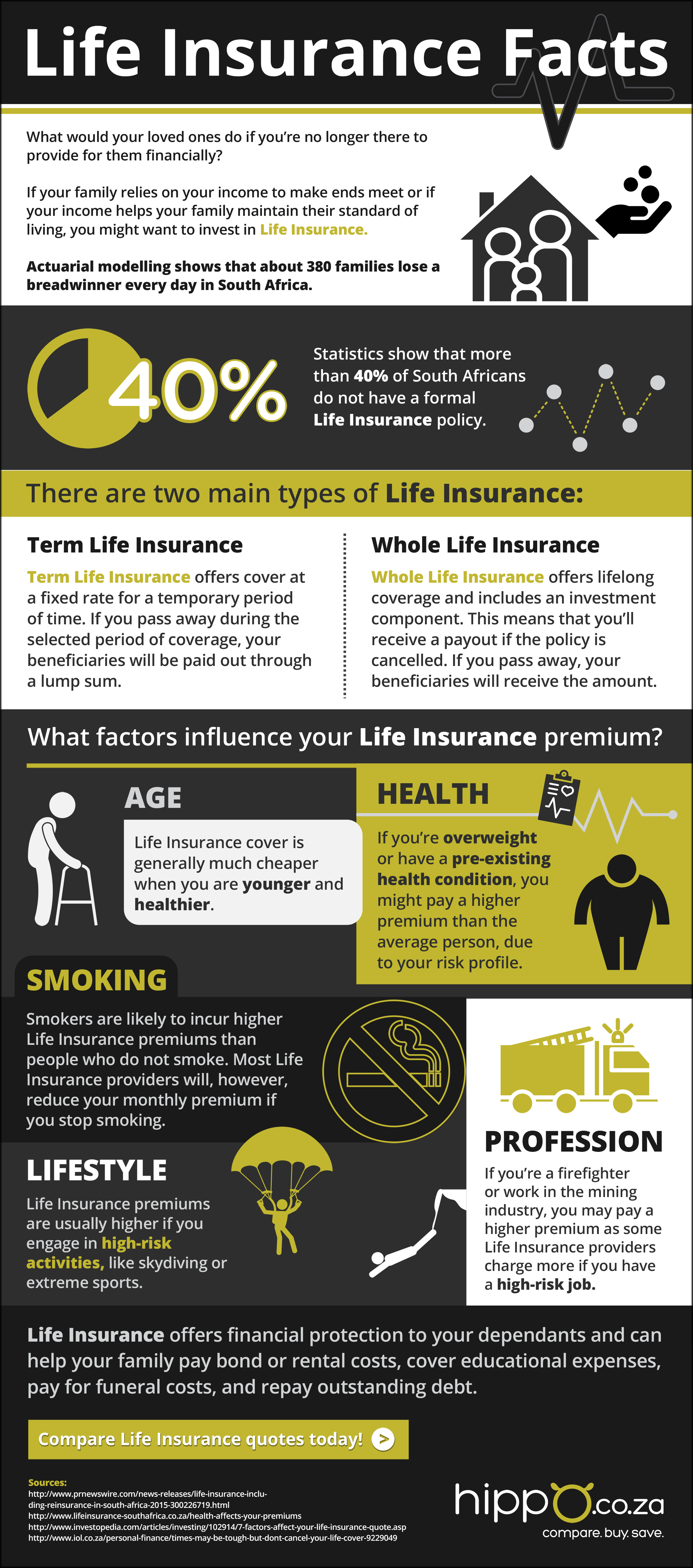

There are a few things in life that genuinely get better with age wine, friendships, and your Spotify algorithm. But when it comes to life insurance? Sooner is definitely better. If you're in your 20s or 30s thinking, “Life insurance? That’s for people with a will and a weekend garden,” you're not alone. But here's the catch the longer you wait to get cover, the more it’s likely to cost. And by the time you feel old enough for it, you’ll be paying extra for the delay.

Welcome to your third decade on Earth - a strange mix of being old enough to remember what a dial-up tone sounds like, but young enough to still want to call your dad’s friends “uncle”. You’re living your life, building a career, a side hustle, a family, or a home, and next thing you know, you’re met with all sorts of responsibilities no one warned you about.

Would you rather pay more now or later? That’s the excess question! It’s like buying a new TV on credit—you could pay it off in small monthly installments (but end up paying way more in the long run) or pay upfront and be done with it. When it comes to car insurance, the logic works in reverse: pay more now with higher premiums and have a smaller excess when you claim, or pay less each month and be prepared to fork out some hard-earned cash when something goes wrong.

All Risk Insurance protects your valuables when you take them outside your home, but does it cover everything? From exclusions to policy limits, understanding your coverage is crucial. Learn the five must-knows about All Risk Insurance, so you can safeguard your possessions the right way. Get smarter about insurance today!

Finding business funding doesn’t have to be stressful. Whether you need to sustain, grow, or launch your business, there are various options available in South Africa. From working capital loans to government schemes and crowdfunding, explore six funding solutions to help your business thrive. Compare business loan quotes today with Hippo!

As 2024 drew to a close, South African drivers stuck to their favorites, with the Toyota Corolla topping the charts yet again. But beyond the buzz, how do these best-sellers stack up on insurance, fuel costs, and monthly repayments? Dive into Hippo’s breakdown of December’s top cars to find the perfect fit for your lifestyle and budget.

Car insurance is often overlooked, but it is one of the most critical financial decisions a driver can make. This blog explores the risks of driving uninsured, the potential costs of accidents, and the peace of mind offered by affordable coverage options. Read on to learn how to protect your vehicle and your wallet!

The reality is, during your 20s, you slowly begin to build a collection of valuables. You may not even realise it, but that TV, the gaming console, the designer clothes, your personal laptop, the appliances in your kitchen—all of these items add up. Usually, in their 20s people accumulate a sizable number of assets.

Nothing embodies South African manliness more than a bakkie. And the Hilux has long been the alpha male amongst sports-loving, vuvuzela-blasting, replica jersey-wearing, shisinyama-mastering, salad-dodging, carwash-jolling, beer-savouring, biltong-vreeting, nature-loving, tool-wielding, hard-working guys across our World Cup-winning Rainbow nation.

From Midrand to Mamelodi, Alex to Alberton, and Soweto to Spruitview, Gauteng gents between 28 and 35 are buying Polos. They’ve hustled, side hustled, studied, and secured jobs to get these iconic whips which are rightfully their pride and joy. They’ve grafted hard for these status symbols and the associated lifestyle of a Polo player.

Picture this: it’s life after lockdown and you are finally back on track with your budget. You’re relieved that you can afford to pick up those payments you decided to drop to spare your pocket. You can insure your car again… But then comes the shock: your premiums are suddenly far higher than what you were paying before the lockdown! What happened?

Unveil the essential role of event liability insurance in safeguarding the success and financial stability of events. Whether orchestrating corporate functions or personal celebrations, this insurance provides peace of mind, bolsters credibility, making it an indispensable asset for discerning event planners seeking to ensure seamless and secure events.

Is your car on the shopping list of South Africa's brazen car thieves? Compare the list of the most commonly stolen cars with the bestselling cars and you'll notice that this country's thieves seem to favour the same vehicles as most of the honest population. Let's look at the most frequently stolen or hijacked vehicles in SA and how these numbers might affect you as an owner.

You might already be a black belt when it comes to finding deals on things like smart phones and sneakers, but the amount of money you save by shopping smart shouldn’t stop there. Comparisons can help you find savings on bigger (unavoidable) expenses like car insurance, medical aid and even your home loan. Here’s how.

Understanding any contract that contains a lot of industry-specific jargon can be tricky for the everyday person. When it comes to a life insurance policy, understanding what you're covered for, what the specific benefits and payments are, and what the insurance company is and isn't committing to is very important.

Could the unexpected devastate your business? A power outage. A disgruntled or injured employee. A flash flood or hailstorm. Don't allow unexpected business interruptions caused by uncontrolled elements to knock your business into the red zone. Whatever emergencies or disasters could arise, preparing for them will help your company weather any storm.

Africa holds a fortune of resources, minerals, and wealth. Accessing this well of potential, however, has historically been a struggle for its inhabitants. That’s all changing though. Countries across Africa are working towards developing cities that can compete internationally in business, tourism, and resources.

Any entrepreneur knows that keeping up with expenses when you’ve just started out can be overwhelming. Not only do you have all the expenses you did in your personal capacity, but on top of that you now have to cover business expenses like accounting software, business insurance, website hosting, and more.

While Car Insurance is not legally required for car owners in South Africa, many of us would agree it’s important cover to have. Fixing parts that have been damaged in an accident, whether your fault or not, can be costly and Car Insurance is a good financial fall back drivers can have to protect themselves when it might happen.

The year may not be over yet, but with summer around the corner there’s no time like the present to do a bit of spring cleaning. Spring cleaning need not only apply to your household though, your finances can be just as important to spruce up as your carpets. With threats of more petrol price hikes in the near future, a number of South Africans are tightening up their budgets and relooking at their finances. With this mind, here are a few tips to help you spring clean your finances.

According to a survey conducted by the Organ Donor Foundation (ODF) in 2017, 4 300 adults and children in South Africa are in need of a new organ, but only 361 transplants took place last year. Their studies further reveal that only around 0.2% of South Africans have registered as organ donors. South Africa is clearly in need of more donors, but many don’t understand the process, and possibly don’t know that one person can help up to 50 people through donating various organs and tissues.

Working from home is just like running a business on a main street. You must conduct yourself in a professional manner when dealing with customers. You must ensure that your products and services are up to the standard your clientele expect. Adding to this, you face the same risks and liabilities as any other company.

The purpose of a Funeral Cover policy is to cover the burial expenses such as buying a casket and paying the funeral director when you or a loved one passes away. It’s comforting to know that you’re financially protected against a death in the family and that your surviving loved ones can grieve without having to worry about how those funeral bills are going to be paid.

Legal procedures can cost large firms millions of dollars each year. Recently, two well-known brands were on the receiving end of major lawsuits launched by consumers. In 2017, Johnson & Johnson were ordered to compensate a Californian women who alleged she developed terminal ovarian cancer after using the company's talc-based products. Closer to home, a class-action lawsuit has been brought against Tiger Brands and its subsidiary Enterprise Foods for the at least 183 known deaths as a result of the listeria outbreak.

Starting up your own business can be a fun adventure. Being your own boss means that you can run your company how you’ve always wanted to, set your own hours, and even work from home. But while there are a host of things that will be new and exciting you also have to think about protecting your business’s finances and assets. Having Business Insurance is a vital part of running your business smoothly.

A retirement annuity (RA) is a type of investment product where individuals contribute monthly cash payments to ensure a regular income after retirement. Unlike a Life Insurance policy, which provides financial stability for a family after the insured breadwinner dies, the savings from a retirement plan benefits the member of the annuity when they withdraw from an active working life one day.

The South African Savings Institute (SASI) launched National Savings Month in Sandton in July 2017 as a reminder that we should all put some money away for a rainy day. Saving, however, means different things to different people. Some prefer to put their money in a savings account, others take out a Life Insurance policy, make off-shore investments, buy real estate or keep their money in stokvels.

With last year’s crime stats showing that break-ins at residential properties is the third most common crime in the country (at over a quarter of a million cases in 2016 according to a Business Tech report) do you know how likely it is that your home will be broken into? The architecture of your house can trigger burglary, and you probably aren’t even aware of it.

Motorcycle enthusiasts know that their lifestyle is more than wearing leathers, or going on unplanned adventures with fellow bikers. Sure, nothing beats the feeling of the wind in your face, the scenery, the smells and that sense of freedom, but imagine this sensory feast amplified by a rally or run where you can not only show off your bike but also your riding skills.

In South Africa, by last reports, approximately 11.9 million children (64% of all South African children) live in poverty. The closest possible consensus tells us that some 1.7 million children (9% of all South African children) still live in informal housing such as shacks in backyards or squatter settlements. Due to the number of independent adoption institutions in South Africa, and how loosely regulated they are, no one knows for certain how many adoptions of non-blood related children there are or have been in the country.

In September 2016, the Automobile Association (AA) published its first annual ‘Entry Level Vehicle Safety Report’, to identify and compare the safety features in 23 motor vehicles available on the South African market for under R150 000. Poor economic growth, coupled with the increasing price of new motor vehicles has put pressure on young South African drivers, who are looking for an affordable yet safe vehicle. Worryingly, those looking for a vehicle seem to be more preoccupied with the affordability of a vehicle and not its safety features.

A recent study performed by Pharma Dynamics, has revealed interesting results on what the most stressful jobs in South Africa are, and surprisingly, the common corporate-related jobs aren’t at the top of the list. Stress can be measured in different ways, and different jobs can surface different types of stress-related symptoms, but according to the 2 000 respondents who come from over 40 different professional backgrounds, which professionals are the most stressed out?

Most of us are generally aware of the strategically placed luxury items which regularly feature close to the checkout counter of a grocery store. These items will usually include what retail outlets sometimes refer to as “impulse buys” being chocolate, sweets and snacks. What many of us do not put much thought into is how much the remainder of the store’s layout can influence our shopping behaviour.

The faster you can sell your home, the faster you can access the capital you’ve invested in it and move on with your life. The reality, though, is that many houses sit stagnant on the market for several months. This not only eats into profit but may prevent you from moving forward with your property investments. It also means that expenses, like your bond and Household Insurance, keep ticking over all the time while it’s on the market.

Every year, companies and researchers run surveys across a variety of disciplines. Most of these studies shed light on customer or civil behaviour, but some also serve as eye-openers that can help us make informed decisions about certain aspects of our lives. Hippo.co.za gathered five statistics from the last three years to illustrate the importance of Life Insurance and planning ahead.

It was a turbulent year for the South African economy. From power shortages, drought and the axing of the finance minister to being downgraded by ratings agencies to a notch above “junk”, the country took a serious financial hit. But, with the reinstatement of Finance Minister Pravin Gordhan and a steadying Rand offering some relief, all may not be lost. Even though economic growth is of concern, we also know that where there have been problems, there are lessons for us to learn as well.

Great filmmakers move us because they splice together the joy and heartache of life. Nowhere is this emotional rollercoaster more apparent than in comic portrayals of funerals. As the playwright George Bernard Shaw so aptly put it: “Life does not cease to be funny when people die any more than it ceases to be serious when people laugh.”

Some people are simply far too driven to be slowed down by the march of years. Their work will never be done, and although they may stop to smell the roses it will be when their schedules permit. It’s this sense of ambition and drive which inspires us all and assists in bolstering our otherwise flagging economy.

According to an article on Fin24, only about 10% of South Africans have a will. This seems like risky behaviour when the cost of drafting a will is the same amount you might spend on a gift for someone or a night out on the town. But in fact, a proper will could be the most important gift you ever give your loved ones besides having things like Life Insurance and Funeral Cover policies in place, so that they’re looked after when you’re gone. A will is a way of protecting your legacy and ensuring that after you pass away, your belongings and money are distributed as you want them to be.

As human beings, we're always pursuing meaningful experiences that add value to our lives. For some people, living life to the fullest often means pushing the boundaries. We want to accomplish great things before we depart this earth. That’s why we sometimes deliberately challenge our senses – which serve to shield us from danger – by engaging in extreme activities. We broaden our horizons by travelling to every country in the world, even the ones that top the "Most Dangerous Countries" list.

In an era where tobacco is one of the biggest public health threats, many smokers have embraced electronic cigarettes as a less harmful alternative to tobacco products. Some of these battery-powered devices look like traditional cigarettes and cigars, and all of them produce flavoured steam that not only simulate tobacco smoke, but also deliver a smaller amount of toxin-containing nicotine.

The most popular science-fiction and fantasy adventurers often lead relatively intense and extraordinary lives, which is why we find them so compelling. But, saving the world from the forces of darkness does not come without risk. Not only do their pursuits jeopardise our heroes' lives, it can also have an impact on the future of their dependants.

Over the years, many South Africans have asked this one simple question, “Where has my airtime gone?. In response, there have been many answers from providers, some have been useful while others have seemed too vague or shifted responsibility. In this article, we’ll look at the most likely causes of airtime loss and what you can do to manage your data effectively. We’ll also take a look at how you can protect your privacy and data. While our goal is to protect your data, remember to also protect your hardware with Cellphone Cover.

For some of us, owning a motorbike is more than just an affordable means to get to work. It invokes a feeling of identity and freedom. When on the road, every toss and lean fires up the senses; every bump and vibration contributes to an exhilarating adventure. If you consider riding as a hallowed experience, you will know there's nothing that fuels your passion like a motorbike rally or run. It's a chance to rub shoulders with like-minded people, and an occasion where individual riders and motorbike clubs truly become a community.

Since its inception in 2008, Airbnb has experienced mounting success among travellers looking for low cost accommodation options without having to compromise on comfort. With listings in more than 35 000 cities and 192 countries, Airbnb rivals the conventional hospitality business model by allowing guests to rent lodgings online and directly from private property owners.

You may not feel comfortable reflecting on the subject of death, but sadly there will come a time when funeral arrangements have to be made for you and your loved ones. And, even though you cannot elude death, you can ensure you are well prepared for this unfortunate event by taking out funeral cover.

Hippo Blog Categories